Filing taxes helps individuals access important benefits—like the monthly, tax-free Canada Child Benefit—and puts money back in their pockets.

With help from volunteers this past year, 16,350 Newfoundlanders and Labradorians got over$52.4M in tax refunds, credits and benefit payments. The Community Volunteer Income Tax Program (CVITP) is a collaboration between the Canada Revenue Agency, community organizations and their dedicated volunteers who offer free tax filing to people with modest incomes. Now, while volunteer and host organization recruitment is needed province-wide, they have an immediate need in Corner Brook and Deer Lake. Natasha Brewer says training is provided. She says filing taxes helps individuals access important benefits—like the monthly, tax-free Canada Child Benefit—and puts money back in their pockets. This can help youth, newcomers, seniors, Indigenous community members, and many others access the benefits and credits they’re entitled to.

Brewer says host organizations can qualify for a laptop through their donation program along with free software. She says volunteers will gain valuable experience, support and additional knowledge. To register to become a host organization or volunteer go to canada.ca

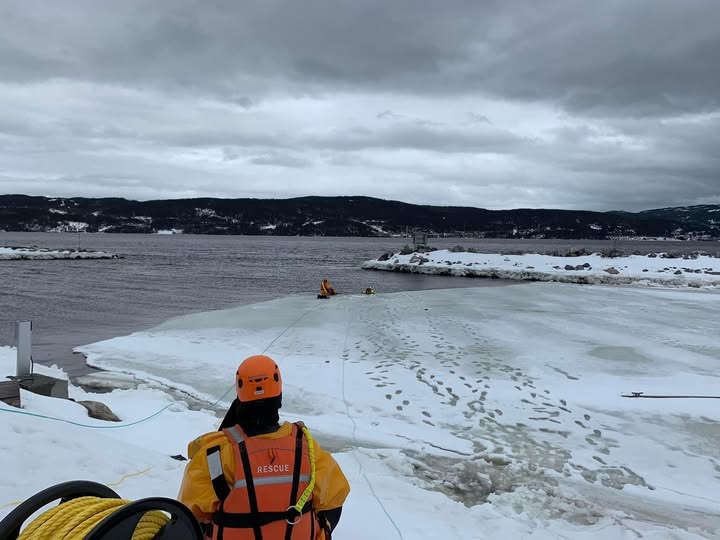

RNC training taking place in Corner Brook this weekend on West Valley Road, signage will be in place

RNC training taking place in Corner Brook this weekend on West Valley Road, signage will be in place

Police find more than a kilogram of cocaine at a Deer Lake home, one man and two youth arrested

Police find more than a kilogram of cocaine at a Deer Lake home, one man and two youth arrested

Police are looking for a snowmobile stolen from Stephenville

Police are looking for a snowmobile stolen from Stephenville

Bay of Islands Volunteer Search and Rescue putting a pause on new members to allow time to train

Bay of Islands Volunteer Search and Rescue putting a pause on new members to allow time to train

A convicted murderer from Corner Brook gets day parole

A convicted murderer from Corner Brook gets day parole