Since April 1, 2019, Newfoundland and Labrador has been regulating payday loans.

New high-cost credit regulations came into effect this past weekend, making Newfoundland and Labrador the first Atlantic province to implement a regulatory regime specific to high-cost credit lenders. The purpose of the new rules is to better protect consumers who may need to use high-cost credit services to take out a loan. The new rules include prohibited practices for high-cost credit lenders, as well as specific guidelines lenders are required to follow in order to enter into a credit agreement with a consumer. A loan with an interest rate at or above the Bank of Canada rate, plus 22 per cent, is considered a high-cost credit product in Newfoundland and Labrador under these new rules. This is tied with Quebec for the lowest threshold in the country. Since April 1, 2019, Newfoundland and Labrador has been regulating payday loans. Payday loans are for small amounts of less than $1,500 with payment terms under 62 days. The maximum cost of borrowing for payday loans in this province is $14 per $100 loaned, which is the lowest in the country.

RNC training taking place in Corner Brook this weekend on West Valley Road, signage will be in place

RNC training taking place in Corner Brook this weekend on West Valley Road, signage will be in place

Police find more than a kilogram of cocaine at a Deer Lake home, one man and two youth arrested

Police find more than a kilogram of cocaine at a Deer Lake home, one man and two youth arrested

Police are looking for a snowmobile stolen from Stephenville

Police are looking for a snowmobile stolen from Stephenville

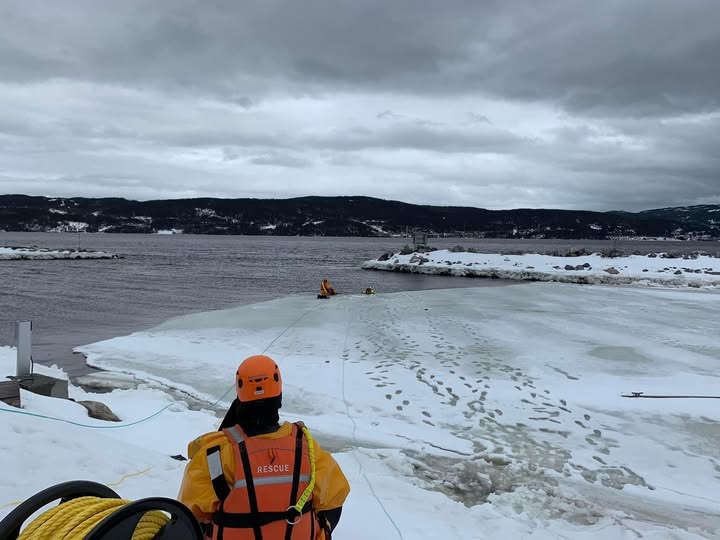

Bay of Islands Volunteer Search and Rescue putting a pause on new members to allow time to train

Bay of Islands Volunteer Search and Rescue putting a pause on new members to allow time to train

A convicted murderer from Corner Brook gets day parole

A convicted murderer from Corner Brook gets day parole